Get the free popeyes hr number for employees

Fill out, sign, and share forms from a single PDF platform

Edit and sign in one place

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

How-to Guide on Obtaining Your Popeyes W-2 Form as a Former Employee

How do you understand your W-2 form?

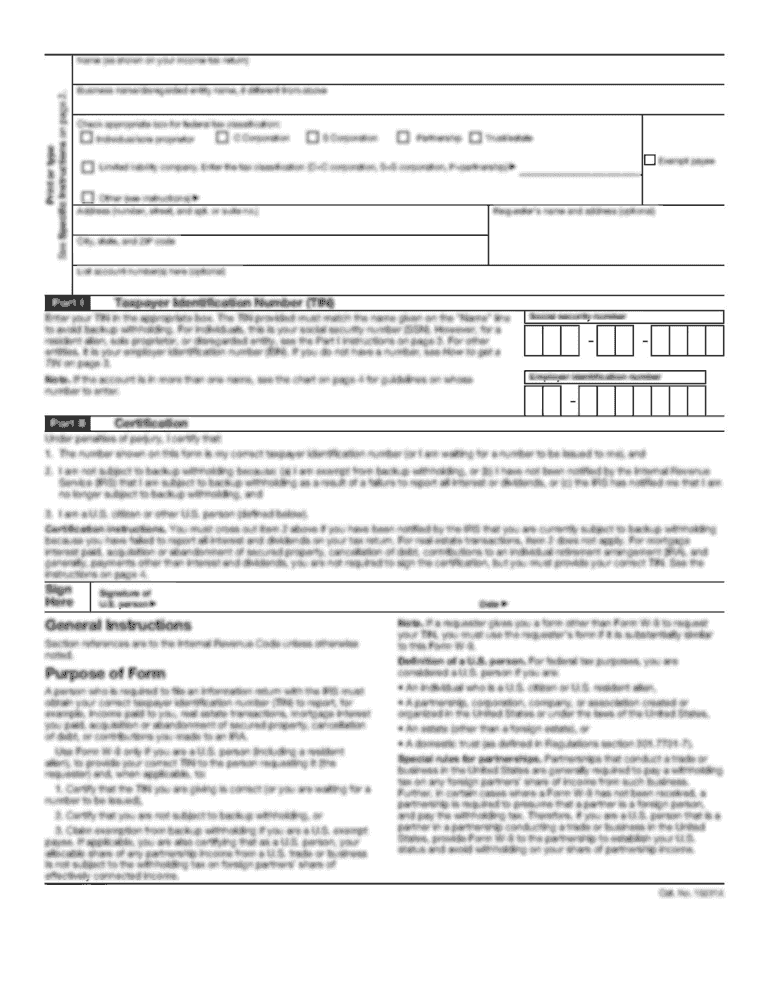

The W-2 form is a vital document that summarizes an employee's earnings and the taxes withheld during the year. For former employees, understanding this form is essential for accurate tax filing. Popeyes, like most employers, issues W-2 forms to report your annual wages and the taxes deducted from your paycheck.

-

A W-2 Form is a tax document that employers must send to their employees and the IRS to report annual wage and tax information.

-

This form is crucial for completing your federal and state tax returns as it provides the necessary earnings information.

-

Popeyes typically issues W-2 Forms electronically via their payroll service or through traditional mail.

-

Former employees can generally expect their W-2 forms by January 31 of each year.

How do you access your W-2 form online?

Accessing your W-2 Form online is a straightforward process using your PDFfiller account. Ensure that you remember your login credentials for a smooth experience.

-

Visit the PDFfiller website, enter your email and password to access your account.

-

Once logged in, look for the 'Forms' tab and select the 'W-2 Forms' category.

-

If your form is missing, check your spam folder for emails from Popeyes or PDFfiller. You can also contact their support for assistance.

-

Use this URL [insert link] to reach the direct W-2 retrieval page provided by Popeyes.

What do you need to fill out your W-2 form?

Filling out your W-2 form accurately is essential to avoid tax issues. Start by reviewing your information carefully.

-

Typical fields include your Social Security number, employee details, and tax withholding amounts.

-

Verify that all personal details match your official identification to prevent discrepancies.

-

Cross-check the amounts reported on your W-2 with your final pay stub for accuracy.

How can you edit your W-2 form using pdfFiller?

Editing your W-2 form is easy with pdfFiller's array of editing tools that allow for seamless corrections.

-

Use tools to highlight text, add comments, or correct information directly on the PDF.

-

Simply click on the field you want to edit, type in the correct information, and save your changes.

-

Once finished, download the edited form or save it to your paperless account.

What are the tax implications of your W-2?

Understanding the tax implications of your W-2 form is crucial as it directly affects your tax returns. This document serves as a proof of income, which the IRS uses in determining your tax obligation.

-

Your W-2 provides the IRS with your earnings information and the taxes you've already paid.

-

If there are inconsistencies in your W-2, contact Popeyes or the payroll service immediately.

-

Consult a tax professional if you’re uncertain about how to handle your W-2 form when filing taxes.

What are the security considerations for your W-2 form?

Protecting your W-2 form is essential as it contains sensitive information that could be exploited for identity theft.

-

Keep your W-2 in a secure physical location or opt for a password-protected digital version.

-

Always be vigilant after tax season for any unusual activity in your financial accounts.

-

pdfFiller uses encryption and secure servers to safeguard your documents and personal information.

How can you manage your documents with pdfFiller?

Using pdfFiller for document management streamlines your workflows, providing an efficient solution for organizing your forms.

-

pdfFiller offers features like editing, e-signing, and sharing documents all in one place.

-

After editing, you can share the W-2 form directly from your account to relevant parties via email.

-

Cloud solutions offer accessibility from any device, enhancing collaboration and document management.

Frequently Asked Questions about popeyes payroll number form

What should I do if I don’t receive my W-2 from Popeyes?

If you haven't received your W-2 by mid-February, contact Popeyes' HR or payroll department to request a duplicate. You can also access your W-2 online via your PDFfiller account.

Can I access my W-2 form after I’ve left Popeyes?

Yes, former employees can access their W-2 forms online or request a physical copy from the HR department. It's important to keep company records updated in case of address changes.

What is the deadline for receiving a W-2 form?

Employers are required to send W-2 forms by January 31 each year. Ensure to check your account and your email for this document.

Is it possible to receive a late W-2 form?

Yes, if you changed your address or the employer encountered issues, your W-2 may be delayed. Contact HR for clarification and to verify your address.

How do I file my taxes if my W-2 hasn’t arrived?

If your W-2 is delayed, you can file your taxes using your last pay stub to estimate your earnings. However, you should correct your return later when your W-2 arrives.

pdfFiller scores top ratings on review platforms